Annual Results 2025

Datwyler with increased profitability and sound Healthcare momentum

遗憾的是,此页面的内容没有中文版

用谷歌翻译Ad hoc announcement pursuant to Art. 53 LR SIX Swiss Exchange | 12. February 2026

In the 2025 financial year, Datwyler generated revenue of CHF 1’100.5 million. Adjusted for negative currency effects of -3.7%, the company achieved organic growth of 3.1%. Due to these currency effects, reported revenue was overall 0.6% below the prior-year level. The Healthcare division developed dynamically, and the “ForwardNow” transformation program has already contributed to a sustained improvement in profitability. The EBIT margin increased significantly to 12.4%. With the announcement of a majority stake in Capsul’in, Datwyler is also sharpening its position in the attractive Food & Beverage business. Based on stable free cash flow, an unchanged cash dividend of CHF 3.20 per bearer share will be proposed at the Annual General Meeting. Datwyler confirms its mid-term objectives and is confident of an incremental increase in revenue and profitability.

All profit figures mentioned from the previous year have been adjusted for one-time costs related to the transformation program.

Sustained improvement in results and solid financial basis

Datwyler (SIX: DAE), a leading supplier of system-critical elastomer components, made significant progress in the 2025 reporting year, consistently aligning itself for profitable growth. When adjusted for currency effects, sales grew by 3.1% to CHF 1’100.5 million (previous year CHF 1’107.7 million), underpinned by dynamic development in the Healthcare division. Despite negative currency effects, Datwyler increased its operating result (EBIT) by 15.7% to CHF 136.6 million (previous year adjusted: CHF 118.1 million) in the reporting year. The EBIT margin rose significantly to 12.4% (previous year adjusted: 10.7%). The improved profitability resulted from economies of scale in the Healthcare business, an improved product mix, and a sustained contribution to earnings from the “ForwardNow” transformation program, launched in 2024. Despite a decline in revenue, an EBIT margin of 12.6% was achieved in the second half of the year, clearly underscoring the operational progress and significantly exceeding the adjusted prior-year figure of 9.5%. The net result for the reporting year increased to CHF 80.8 million (previous year adjusted: CHF 69.0 million), and earnings per share rose to CHF 4.75 (previous year adjusted CHF 4.06). Operating cash flow amounted to CHF 173.8 million (previous year: CHF 171.7 million), while free cash flow reached CHF 129.4 million (previous year: CHF 127.9 million). Despite the growth-related increase in working capital, Datwyler further strengthened its balance sheet and reduced its net debt ratio (net debt/EBITDA) to 1.8 (previous year adjusted: 2.2). The Board of Directors will therefore propose an unchanged cash dividend of CHF 3.20 per bearer share and CHF 0.64 per registered share at the Annual General Meeting.

Datwyler made important operating progress in 2025 and significantly improved profitability. In addition, we have systematically developed our project pipeline with a higher proportion of premium products and services for world-leading customers and, at the same time, implemented significant optimizations within the company with our “ForwardNow” transformation program. This puts us in a good position to further strengthen Datwyler’s sustainable and profitable growth.

CEO

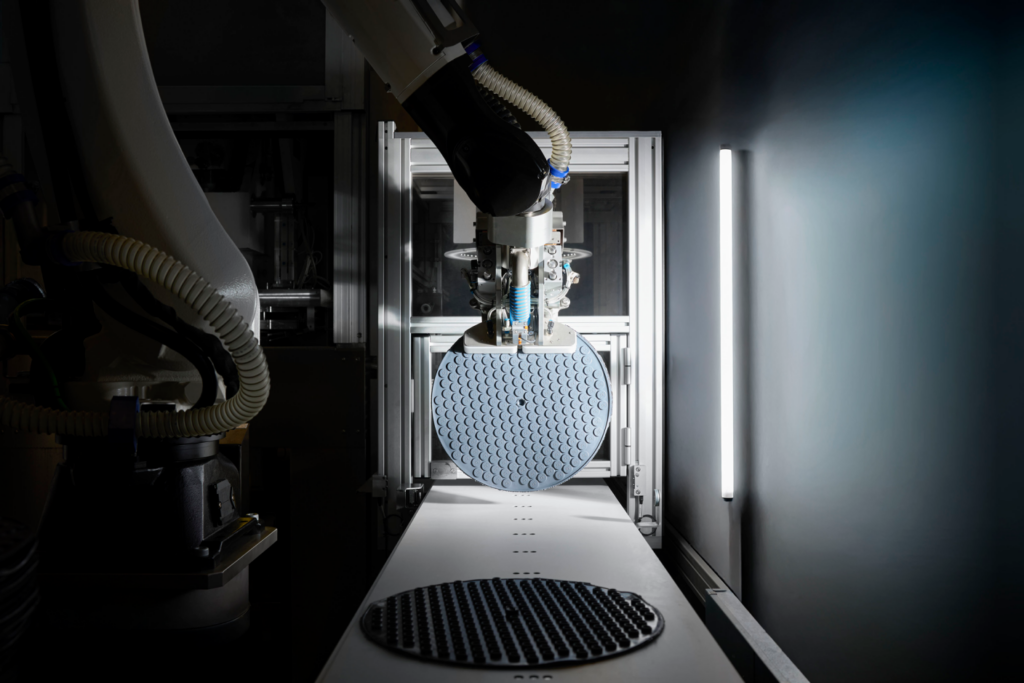

Dynamic Healthcare business with sustained margin improvement

When adjusted for currency effects, the Healthcare division increased sales by 8.1% to CHF 462.7 million in 2025 (previous year: CHF 446.0 million). The recovery in customer demand that began towards the end of the first quarter continued as expected in the second half of the year, meaning that the destocking phase at customers has largely finished. Business development was also supported by the start of series production for several customer projects with high-value products. These include spray-coated NeoFlex plungers for pre-filled syringes and components for a leading GLP-1 drug for weight reduction. The share of products and services in the high-value segment therefore increased to 35% of sales, while in the project pipeline, which includes future customer projects in development and industrialization, it now amounts to around 70%.

Profitability improved significantly, supported by higher capacity utilization, a more favorable product mix, and targeted efficiency measures, including those from the “ForwardNow” transformation program. The operating result (EBIT) increased by 28.3% to CHF 79.3 million (previous year adjusted: CHF 61.8 million), and the EBIT margin increased to 17.1% (previous year adjusted: 13.9%). Operating progress was even more pronounced in the second half of 2025, with EBIT margin at 17.4%, more than 40% above the adjusted figure of 12.2% for the previous year. At the same time, the healthcare business is benefiting from structural growth drivers, in particular the increasing self-administration of injectable biologics and stricter regulatory requirements (EU-GMP Annex 1), which are making the target market for high-quality components grow faster than the market as a whole.

Industrial division achieves operating progress, strengthens earnings base and streamlines its product portfolio

The Industrial division maintained stable operating revenue of CHF 642.8 million in the reporting year. Taking currency effects into account, this corresponded to a decline of -3.3% compared with the previous year (CHF 664.8 million). While demand in the automotive and industrial markets in Europe and the US remained subdued, business in China continued to show positive development. The acquisition of strategically relevant new business strengthened the medium- and long-term order backlog. In the Food & Beverage segment, Datwyler expanded its capacities for the production of aluminum coffee capsules. At divisional level, the targeted implementation of operational improvements and consistent cost management in a highly challenging market environment allowed for an increase in profitability. EBIT increased to CHF 57.3 million (previous year adjusted: CHF 56.3 million), and the EBIT margin increased to 8.9% (previous year adjusted: 8.5%). The improved profitability was particularly evident in the second half of 2025, with an EBIT margin of 9.1%, well above the adjusted figure of 7.6% for the previous year.

The earnings base of the Industrial division was further strengthened in 2025, in particular through its strategic alignment as part of “ForwardNow”. The merger of two business units to form the Transportation & Electronics unit, structural measures and the relocation of activities from the Vandalia site improved cost and capital efficiency. At the same time, Datwyler further strengthened its position in the Chinese automotive business, which now accounts for over a third of automotive sales, and won new projects in areas such as air suspension, modern braking systems (brake-by-wire), thermal management and high- and low-voltage connectors. In the Food & Beverage business, the majority stake in Capsul’in strengthens Datwyler’s market position for Nespresso-compatible aluminum capsules and adds a revenue contribution in the mid-double-digit million CHF range. In General Industry, the strategic focus on target markets such as energy, aerospace and medical devices was further intensified, resulting in new orders and initial revenues with new customers.

Datwyler sharpens its growth strategy

Datwyler used this reporting year to further develop its growth strategy and focus specifically on high-value components and increasingly on market segments with long-term growth trends, high potential for differentiation and sustainable entry barriers. Strong material expertise, customer-oriented solution design, and the efficient industrialization of products remain central to the strategy. By combining these core competencies in a targeted manner, Datwyler creates decisive added value for its customers – from material development and joint solution-finding to industrialization in global, customer-oriented technology and production networks.

At the end of 2024, Datwyler launched its “ForwardNow” transformation program with the aim of strengthening operational performance in a sustainable manner and enabling profitable growth. “ForwardNow” is proceeding according to plan, and the targeted earnings contributions remain realistic. Implementation in the four defined action areas – optimizing the production network, enhancing commercial excellence, focusing on the product portfolio, and introducing a target operating model – is already starting to have a sustained impact. Focused and disciplined capital allocation ensures that investments are balanced against margin potential, cyclicality and the investment needs of the respective business models in the target markets.

Datwyler also continued to improve operational efficiency in its use of resources and materials. In particular, greenhouse gas emissions (Scope 1 and 2) were reduced by 52.1% compared with the base year 2023. Elastomer waste, which is the most important waste category, was reduced by 2.2% compared with the previous year. The near-term reduction targets have been successfully validated by the Science Based Targets initiative (SBTi). EcoVadis also once again awarded the company the platinum standard for its sustainability performance.

Orderly succession in the Board of Directors ensuring continuity and strategic oversight

At the ordinary Annual General Meeting in 2026, Jürg Fedier and Gabi Huber will retire from the Board of Directors after eleven years and after thirteen years of service respectively. Stephanie Bregy and Christian Holzgang will be proposed at the Annual General Meeting for election to the Board of Directors. Stephanie Bregy has been Group General Counsel of SBB since 2019. Prior to this, she held various international roles at Novartis and brings extensive experience in building and leading legal and compliance teams. Christian Holzgang has been CEO of the Amsonic-KKS Group since 2024 and has many years of management experience in the manufacturing industry.

The Board of Directors has also nominated Jens Breu to succeed Paul Hälg as Chairman of the Board of Directors. Paul Hälg will continue to support the “ForwardNow” transformation program until the ordinary Annual General Meeting in 2027, after which he will retire. As long-standing CEO of the listed SFS Group, Jens Breu knows Datwyler’s target markets and is very familiar with the strategic issues of a global component supplier. He has been a member of Datwyler’s Board of Directors and a member of the Nomination and Compensation Committee since 2019.

Confident outlook for continued increase in earnings and value

Thanks to the sustained improvements from “ForwardNow”, targeted investments in innovation and growth and strong market positions, Datwyler is well positioned in both divisions. In the medium term, the company continues to expect annual organic sales growth in the higher single-digit percentage range and an EBIT margin of over 17%.

Despite ongoing geopolitical and trade policy uncertainties, Datwyler is confident that it will continue increasing revenue and profitability in 2026. The Healthcare division remains the key growth driver, supported by the further ramp-up of new series projects, rising volumes in existing customer programs and additional economies of scale. Within the Industrial division, the strategic realignment in the automotive and industrial markets, the growing Asian share and the progress made with “ForwardNow” are laying the foundations for incremental improvement. In the Food & Beverage business, capacity expansion and the majority stake in Capsul’in announced in December 2025 are expected to drive continued revenue growth and further reinforce the company’s position as a leading provider of high-tech sealing solutions in a highly regulated food environment.

Key figures

12 months ended at December 31st, in CHF million

2025 | 2024 | Change |

|

|---|---|---|---|

|

Datwyler Group |

|||

|

Net revenue |

1’100.5 | 1’107.7 | –0.6 % |

|

Operating result (EBIT) before transformation program1 |

136.6 | 118.1 | +15.7 % |

|

as % of net revenue (EBIT margin) |

12.4 % | 10.7 % | n/a |

|

Operating result (EBIT) |

136.6 | 80.2 | +70.3 % |

|

as % of net revenue (EBIT margin) |

12.4 % | 7.2 % | n/a |

|

Division Healthcare |

|||

|

Net revenue |

462.7 | 446.0 | +3.7 % |

|

Operating result (EBIT) before transformation program1 |

79.3 | 61.8 | +28.3 % |

|

as % of net revenue (EBIT margin) |

17.1 % | 13.9 % | n/a |

|

Division Industrial |

|||

|

Net revenue |

642.8 | 664.8 | –3.3 % |

|

Operating result (EBIT) before transformation program1 |

57.3 | 56.3 | +1.8 % |

|

as % of net revenue (EBIT margin) |

8.9 % | 8.5 % | n/a |

Datwyler Group uses certain financial performance measures that are not defined by Swiss GAAP. The definitions of these Alternative Performance Measures (APM) are explained in the Financial Report 2025 (pages F53–F54).

Events

Feb

2026

Presentation of the

Annual Results 2025

Investors and Media Conference // Webcast

1 p.m. (CET)

Please register here for the live event at Park Hyatt, Beethoven-Strasse 21, 8002 Zurich, Switzerland or for the webcast.

downloads

A replay of the web stream presentation will be available a day after the Investors and Media Conference.

Enquiries

Katharina Immoor

SVP Corporate Communications & Investor Relations

Guido Unternährer

VP Financial Communication & Investor Relations