Nine reasons to invest in Datwyler

Markets

Leading positions in attractive markets with long-term growth drivers and very high entry barriers (Healthcare, Mobility, Connectivity, General Industry, Food & Beverage).

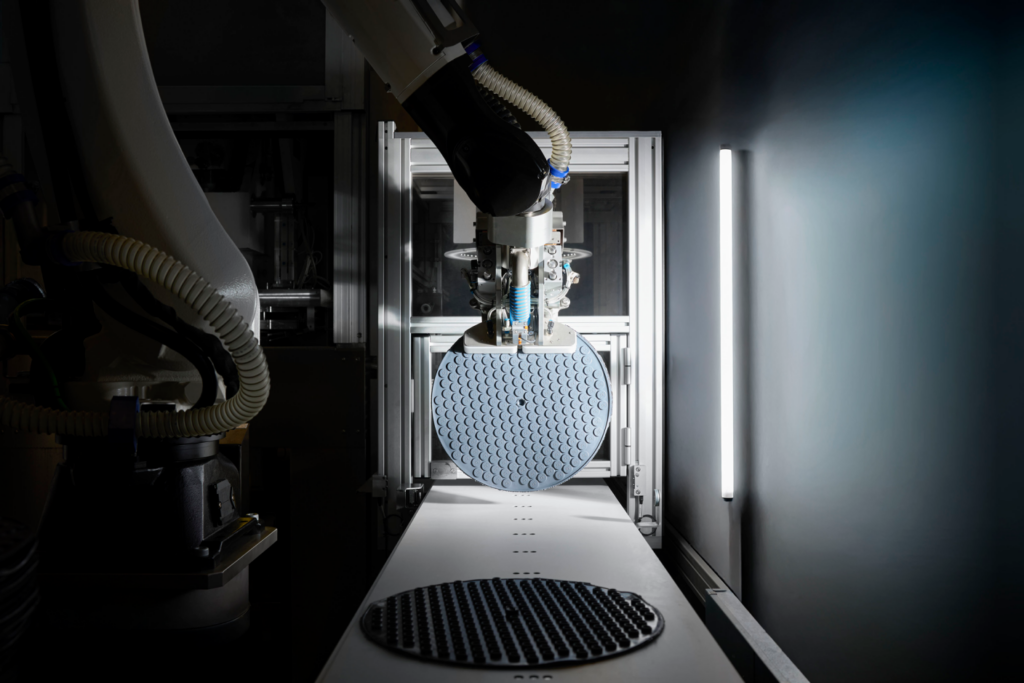

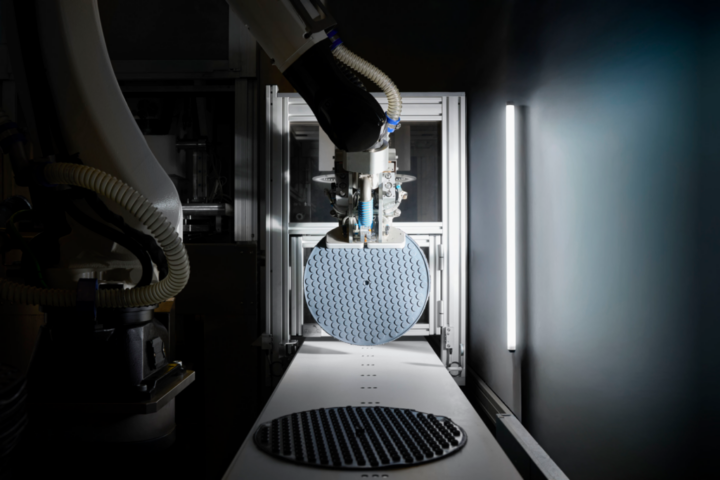

Products

Clear focus on system-critical elastomer components with a significant contribution to the functionality and quality of the end products at a very low share of the total cost of customer systems.

Customers

Long-standing, close customer relationships with global market and innovation leaders generate recurring stable revenue. Some 60% of Datwyler’s revenue is generated with consumable components for customers in the healthcare and food & beverage markets, which are low cyclical and grow long term.

Competencies

High customer value and added value based on recognized core competencies in solution design, material know-how and product industrialization as well as co-engineering, innovative strength and global presence lead to high potential switching costs for customers.

Synergies

Datwyler’s business model enables high synergies and thus competitive advantages through overarching R&D, materials expertise and solution design, through uniform production and IT systems, and through central procurement of similar raw materials and production equipment.

Investment

A global investment program in infrastructure has been implemented, and the focus is on profitable organic growth through scaling of the business model.

Acquisitions

Strategic acquisitions were made to optimize the market and product portfolio and complement the Datwyler business model.

Dividend

Target of continuously increasing dividend with payout >40%.

Growth objectives

Medium-term objectives in a normal operating environment: Annual revenue growth in the higher single digit percentage range, EBIT margin 17% plus, continuous increase in cash flow, net leverage (net debt/EBITDA) <1.5.

Financial informations

Reports and presentations

At Datwyler, we are committed to always providing investors and all other stakeholders with transparent and detailed information on developments in our group of companies.

Communication takes place through the Annual Report, Half-Year Report, Annual General Meeting and at least one press and analyst conference every year.

Visit our publications archive and discover more:

Annual Report 2025

Annual Results 2025 Replay Webcast

Capital Markets Day 2025

Capital Markets Day 2025 Replay Web Stream Presentation

Ad hoc announcements

Through press releases and on our website, we provide up-to-the-minute information on all important projects as required by the ad hoc publicity rules of the SIX Swiss Exchange.

Financial Calender

Reports and conferences

Jul

2026

Publication of the

Half-Year Report 2026

Presentation of the

Half-Year Results 2026

Live Web Stream Presentation

Annual General Meeting

The documents for past Annual General Meetings are available for download in our

archive.

Mar

2026

68. Annual General Meeting

Theater Uri / Tellspielhaus, Altdorf, Switzerland

5:00 pm (CET)

Broad coverage by financial analysts

Contact

We look after the interests of our shareholders. For unanswered questions about Datwyler shares, the Annual General Meeting or our financial publications that cannot be answered by the information on our website, stakeholders may contact our investor relations specialists directly.

Guido Unternährer

VP Financial Communication & Investor Relations

Gotthardstrasse 31

6460 Altdorf

Switzerland

Disclaimer for financial informations

The financial reports, presentations and media releases contain forward-looking statements. These statements reflect the Group’s current assessment of market conditions, economic developments and future events. However, these forward-looking statements are subject to economic, regulatory and political risks, uncertainties, assumptions and other factors over which Datwyler has no control. Unforeseen events could therefore cause actual developments and results to differ materially from those anticipated and from the information published in this documents. To that extent, all forward-looking statements contained in this documents are qualified in their entirety and Datwyler cannot guarantee that they will prove to be correct. Datwyler is under no obligation, and assumes no liability, to update any such forward-looking statements. This documents are neither an offer nor a solicitation to buy or sell Datwyler securities.