2.1 Healthcare Solutions

Datwyler is a leading supplier of system-critical elastomer components for injectable drug delivery systems. These components are used in billions of prefilled syringes, glass vials and cartridges worldwide, improving patients' lives. With a worldwide network of highly automated production facilities, Datwyler is able to supply locally manufactured components to global pharmaceutical companies in the key economic regions. The market for healthcare components is low cyclical and is characterized by high entry barriers and long-term growth trends such as the aging society in industrialized countries or the increase in living standards in emerging markets.

improve patients' lives

Products and services

High-quality rubber components

for prefilled syringes, pens and injection systemsComponents and closures

for injectable drugs in vialsRubber components

for blood collection systems, IV administration sets, disposable syringes, etc.Rubber components

for diagnostics and medical devices

Target groups

Pharmaceutical and biotech companies

Manufacturers and contract fillers of injectable drugs

Manufacturers of diagnostic and medical products

Manufacturers of parenteral drug delivery systems

Geographical markets

Europe

North and South America

Asia

Australia

Further information

Revenue and earnings

Healthcare Solutions achievesdouble-digit organic growth

The Healthcare Solutions business area increased its revenue to CHF 520.3 million (previous year: CHF 466.8 million) in 2022. Adjusted for currency effects and acquisitions, this equates to organic growth of 13.0% in comparison with the previous year. As expected, revenue from components for COVID vaccines declined, with an accelerating trend towards the end of the year.

Datwyler was able to pass the significantly increased costs for input factors onto its customers over the course of the reporting year. The delayed impact of the price increases and the unfavorable development of the product mix caused the EBIT margin to decline to 20.4% (previous year: 22.4%). However, at CHF 106.3 million, the absolute operating result (EBIT) was slightly higher than in the previous year (CHF 104.6 million).

Key developments and priorities

By making the strategically important acquisition of Yantai Xinhui Packing, Datwyler gained direct access to the fast-growing Chinese healthcare market in the first half of the year. The integration work is going to plan despite the pandemic. With the help of Xinhui’s customer contacts and sales organization, Datwyler was already able to substantially increase revenue in China in the year under review.

Datwyler successfully put its second plant into operation at its existing site in India in 2022. This capacity expansion is an important basis for the profitable revenue growth that the company is targeting over the coming years. Datwyler will be able to further optimize its cost structure by transferring products from European plants to India.

Datwyler is investing continuously in the further development and optimization of the product portfolio and is planning to launch new high-quality components for glass containers, cartridges and prefilled syringes in the premium market segment.

As a result of the supply bottlenecks during the pandemic, Datwyler came into contact with a large number of new pharmaceutical and biotechnology companies and was able to significantly expand its customer base. The outcome of this has been continuous growth in the number of project orders for high-quality, FirstLine® components, which will help to increase Datwyler’s market share over the medium term.

Outlook

In the short term, uncertainty will also persist in the healthcare industry in 2023. From today's perspective, revenues with Covid components will continue to decline in 2023. However, success in acquiring new customers and projects should be able to compensate for these effects. At the new Xinhui plant in China, Datwyler is working on continuously upgrading the product portfolio towards higher-value components. The next step is to manufacture Datwyler's standard compound and components locally.

For the medium and long-term future, Datwyler remains convinced about the growth potential of the system-critical components for injectable medicines. New medications are based primarily on biotechnological active substances, which will lead to rising demand for high-quality components. Thanks to the latest investments in the expansion of production capacities and customer support teams and the acquisition of Xinhui in China, Datwyler is in a strong position to benefit disproportionately from the anticipated market growth.

2022 |

2021 |

Change | |

|---|---|---|---|

Net revenue |

520.3 |

466.8 |

+11.5 % |

Operating result (EBIT) |

106.3 |

104.6 |

+1.6 % |

as % of net revenue (EBIT margin) |

20.4 % |

22.4 % |

n/a |

ROCE1 |

23.9 % |

26.4 % |

n/a |

Average capital employed1 |

443.9 |

396.1 | +12.1 % |

Capital expenditures1 |

58.2 |

69.3 | –16.0 % |

Full-time equivalents at 31 December |

2'870 |

2'480 |

+15.7 % |

Datwyler Group uses certain financial performance measures that are not defined by Swiss GAAP. The definitions of these Alternative Performance Measures (APM) are explained in the Financial Report 2022 (pages F60–F62).

2.2 Industrial Solutions

Datwyler is a leading supplier of system-critical elastomer components to the attractive global Mobility, Connectivity, General Industry and Food & Beverage markets. For instance, customer-specific components make an important contribution to driver and passenger safety in more than every second car worldwide. Leading core competencies in solution design, material expertise and operational excellence as well as a worldwide presence with its own production sites form the successful basis for this.

As a recognized development partner, Datwyler maintains close, long-standing relationships with global innovation leaders and has in-depth knowledge of business models, technologies and development trends in the markets it serves.

innovation leaders

Products and services

System-critical components

for brake systems, fuel and engine management, exhaust gas aftertreatment (Selective Catalytic Reduction), active assistance and safety systems, electromobility of the futureSeals and components

for electrical connectors for demanding applications in various markets such as mobility, aerospace or the manufacturing industrySealing components

for upstream systems in the oil and gas industry, aerospace and heavy machinery, power tools, process and water treatment industriesSealing solutions

for portioned food and beverages

Target groups

Automotive system suppliers

Electrical connector manufacturers

Oil and gas service companies

Aerospace and heavy machinery

Manufacturers of power tools

Process and water treatment industries

Manufacturers of portioned food products

Geographical markets

Europe

North and South America

Asia

Further information

Revenue and earnings

Industrial Solutionswith strong second half

The Industrial Solutions business area increased its revenue by 30.2% to CHF 636.1 million (previous year: CHF 488.4 million) in 2022. Adjusted for negative currency effects and the first-time consolidation of QSR’s revenue for eight months, which amounted to CHF 112.8 million, this equates to organic growth of the previous three business units of 7.5%.

Due to the significantly higher input costs and the delayed impact of price increases, the operating result (EBIT) fell to CHF 42.9 million (previous year: CHF 55.8 million), which equates to an EBIT margin of 6.7% (previous year: 11.4%).

This figure includes negative one-off effects resulting from inventories in the acquired balance sheets and impairments on assets due to the temporary closure of the Ukrainian subsidiary totaling approximately CHF 7.5 million.

Contrary to the usual seasonal trend, the Industrial Solutions business area achieved significantly higher organic revenue growth in the second half of the year than in the first half, driven among other things by higher demand from the automotive industry. The EBIT margin also recovered in the fourth quarter. While the three business units Connectors, General Industry and Food & Beverage reported double-digit growth rates, the Mobility business unit was able to maintain its revenue level for the year as a whole. This was in a difficult environment dominated by COVID restrictions in China and declining vehicle production in the important sales market of Germany.

Key developments

and priorities

Through the strategic acquisition of QSR, Datwyler became a leading global supplier of system-critical seals for electrical connector for a wide range of industries in the first half of 2022. The integration work is going to plan, which is already evident among other things from several acquired and additional specific cross-selling projects with the Mobility business unit. Measures to increase efficiency in accordance with Datwyler production standards and the outsourcing of additional product lines from the US locations to the Mexican site will generate one-off costs in the short term, but will further reinforce the leading market position of QSR and thus of the new Connectors business unit.

The Mobility business unit is working successfully on the transformation to electromobility. Various new materials and technologies are opening up attractive new applications in the car of the future. A new global business development team and an expanded global sales engineer network are acquiring new customers and projects. The share of projects focusing on applications in electric vehicles is increasing continuously. At the same time, Datwyler is upgrading its Mobility sites with next-generation injection molding technology so that it will be able to supply its customers worldwide with regionally produced e-mobility components.

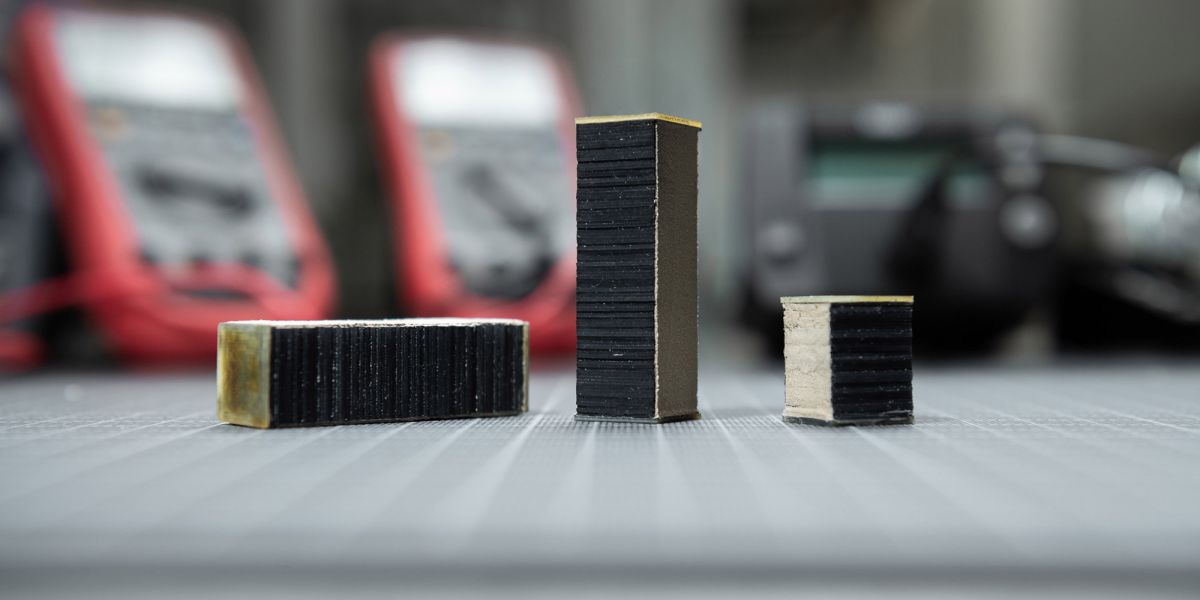

One key technology for the new applications in the vehicle of the future is the electroactive polymers in a stacked design, which Datwyler secured with patents in the year under review. Usage examples include thermal management in batteries, comfort functions such as massage seats, and haptic feedback and morphing surfaces for applications at the human-machine interface. Prototype orders have shown that both vehicle manufacturers themselves and suppliers of technical systems and interiors are very interested in the new possibilities offered by Datwyler’s electroactive polymers.

The Food & Beverage business unit also exceeded market growth by a considerable margin in 2022. The investment program at the Swiss site has been largely completed. In addition, Datwyler was able to realize significant capacity increases at the existing production sites through internal engineering services as part of the continuous improvement process. The switchover to aluminum with 80% recycled materials for the main customer Nespresso was completed.

Thanks to lively demand from the US energy industry, the General Industry business unit generated above-average revenue growth in 2022. Developments in the other target markets were also encouraging, with highlights including some promising prototype orders for new customers. The customers of the Ukrainian site were impressed by how quickly Datwyler’s emergency response plans enabled it to relocate production to other sites.

Outlook

In the short term, the uncertainties predominate in 2023. A possible recession in Europe or worldwide would have a negative impact on demand, especially in the Mobility and General Industry business units.

In order to make further use of growth synergies with QSR, Datwyler will set up a production cell for sample products and visits by European customers at the existing German production site in Cleebronn. The next step planned is to begin mass production of QSR components in Europe. In parallel, QSR’s mold construction and compound development activities will be used as competence centers for all Datwyler sites in North America.

In the medium term, Datwyler is confident about the future in all four business units. The new Connectors business unit has attractive growth prospects due to several megatrends such as electrification, connectivity, the Internet of Things and Industry 4.0. The transformation to electromobility will also give the Mobility business unit the opportunity to increase its revenue share per vehicle.

The General Industry business unit is expanding its successful market development activities and focusing on high-quality components for demanding sectors. And as an expert and efficient production partner to the leading capsule coffee providers, the Food & Beverage business unit is growing at a rate above the market average.

2022 |

2021 |

Change | |

|---|---|---|---|

Net revenue |

636.1 |

488.4 |

+30.2 % |

Operating result (EBIT) |

42.9 |

55.8 |

–23.1 % |

as % of net revenue (EBIT margin) |

6.7 % |

11.4 % |

n/a |

ROCE1 |

10.7 % |

17.8 % |

n/a |

Average capital employed1 |

399.2 |

313.3 |

+27.4 % |

Capital expenditures1 |

43.2 |

40.5 |

+6.7 % |

Full-time equivalents at 31 December |

5'585 |

4'200 |

+33.0 % |

Datwyler Group uses certain financial performance measures that are not defined by Swiss GAAP. The definitions of these Alternative Performance Measures (APM) are explained in the Financial Report 2022 (pages F60–F62).

Continuing operations